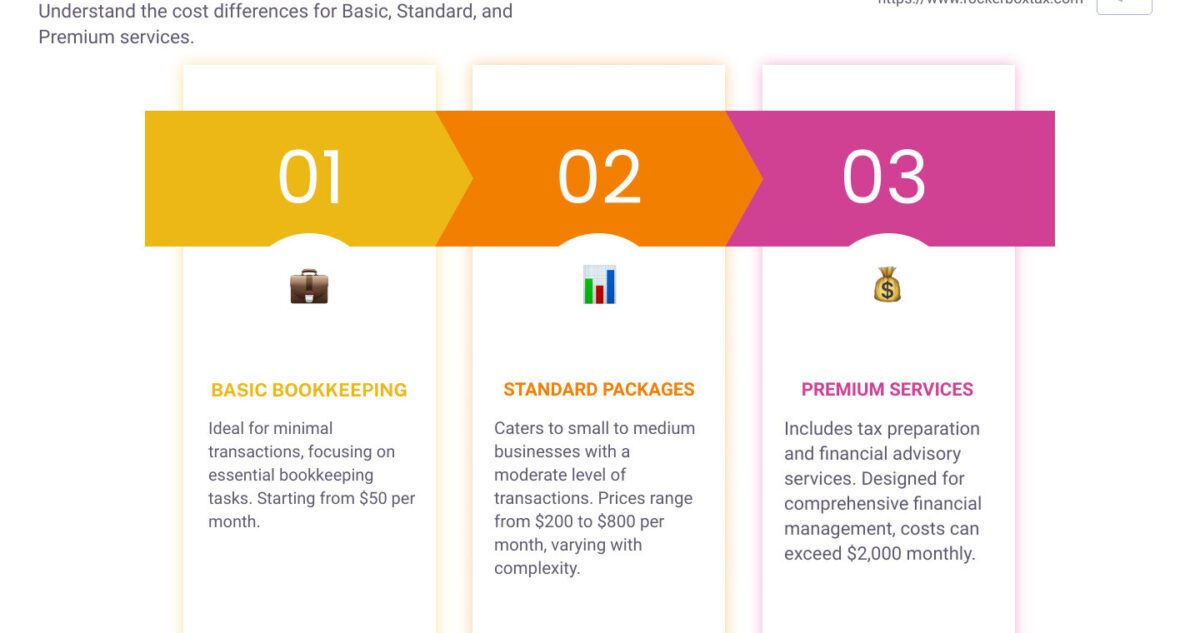

When searching for bookkeeping services price list, you’re likely looking for a straightforward answer. While prices can vary widely based on factors like service scope, location, and expertise, here’s a quick snapshot to give you a starting point:

- Basic Bookkeeping: Starting from $50 per month for minimal transactions.

- Standard Packages: Ranging from $200 to $800 per month for small to medium businesses, depending on complexity.

- Premium Services: Including tax prep and financial advisory, can go upwards of $2,000 per month.

Choosing the right bookkeeping service is crucial for your business’s health and growth. It’s not just about finding someone who can crunch numbers, but also about securing a partner who understands your business and can provide insights that drive profitability.

The importance of pricing can’t be overstated. It’s not simply about cost but value. Investing in a bookkeeping service that aligns with your business needs can save you money in the long run by optimizing your tax position, minimising liabilities, and empowering informed decision-making.

When choosing the right service, consider not only the immediate cost but the depth of service offered. Does the provider have experience in your industry? Can they scale services as your business grows? Do they offer strategic advice beyond mere compliance? Answering these questions will help you find a bookkeeping service that is not just a cost center but a valuable asset to your business.

Understanding Bookkeeping Pricing Models

When it comes to bookkeeping services, not all pricing models are created equal. Each has its benefits and drawbacks, depending on your business needs. Let’s break down the common pricing models you’ll encounter when exploring bookkeeping services price lists.

Hourly Rate

Hourly rate pricing is straightforward. You pay for each hour of bookkeeping work. It’s simple, but it can make your costs variable and somewhat unpredictable. If your bookkeeping needs are minimal or irregular, this might work for you.

- Pros: Flexibility, pay only for what you need.

- Cons: Costs can vary widely, making budgeting difficult.

Fixed-Rate Pricing

Fixed-rate pricing offers a set fee for a bundle of bookkeeping services. This model is great for budgeting because you know your costs upfront. It’s like ordering a combo meal instead of individual items.

- Pros: Predictable costs, easier budgeting.

- Cons: You might pay for services you don’t need.

Value-Based Pricing

Value-based pricing is a bit more abstract. It’s based on the value or outcome the bookkeeping services provide to your business, not just the time spent or tasks completed. This model aligns the bookkeeper’s incentives with your business success.

- Pros: Aligns bookkeeper motivation with business outcomes.

- Cons: Harder to quantify and agree on value.

Percentage of Income

Some bookkeepers charge a percentage of your business’s income. This model scales with your business, making it attractive for growing businesses. However, as your income increases, so do your bookkeeping costs.

- Pros: Scales with business growth.

- Cons: Can become expensive as your business grows.

Per Transaction

Per transaction pricing charges you based on the number of transactions (like sales, purchases, etc.) your business has. This model can work well for businesses with a high volume of transactions.

- Pros: Reflects actual workload.

- Cons: Can be unpredictable if transaction volume fluctuates.

Choosing the right model depends on your business size, transaction volume, and how you prefer to budget. A small business with straightforward bookkeeping might opt for a fixed-rate or hourly rate. In contrast, a rapidly growing startup might see more value in a percentage of income or value-based model.

The goal is to find a bookkeeping service that is not just a cost center but a valuable asset to your business. Each pricing model has its place, and the best choice depends on your specific needs and how you envision the role of bookkeeping within your operations.

Keep these models in mind when considering the bookkeeping services price list and how they can align with your business goals and financial strategies.

Factors Influencing Bookkeeping Costs

When you’re diving into bookkeeping services, understanding the factors that influence costs can be a game-changer. Let’s break down these elements, making it easier for you to navigate the bookkeeping services price list.

Client Size

The size of your business plays a significant role in determining bookkeeping costs. Smaller businesses with fewer transactions and less complex financial needs usually incur lower costs compared to larger enterprises with more intricate financial activities. It’s like comparing the maintenance costs of a cozy studio apartment to those of a sprawling mansion.

Location

Where your business is located can also impact the price of bookkeeping services. For instance, bookkeeping rates in major metropolitan areas like New York City or San Francisco are likely to be higher than in smaller towns or rural areas. This is due to the higher cost of living and operational expenses in larger cities.

Certifications

The qualifications and certifications of the bookkeeper or accounting firm you choose can influence the price. A Certified Public Accountant (CPA) or a bookkeeper with specialized certifications (like a Certified Management Accountant or Certified Fraud Examiner) may charge more for their expertise and trustworthiness. Think of it as paying a bit extra for a master chef to prepare your meal rather than a standard cook.

Experience

Experience matters. A seasoned bookkeeper with years of experience under their belt will likely charge more than someone who’s just starting out. However, their expertise could mean efficiency and accuracy, potentially saving you money in the long run by avoiding costly errors.

Types of Services

The variety of services you need will also affect the cost. Basic bookkeeping tasks like data entry and bank reconciliations might come at a standard rate, but if you’re looking for more comprehensive services such as financial reporting, payroll, or tax preparation, expect the price to go up. It’s akin to ordering a la carte versus a full-course meal.

Service Frequency

How often you need bookkeeping services can also play a part in determining costs. Some businesses might only need a quarterly check-in, while others may require monthly or even weekly services to keep their finances in check. More frequent services mean more hours worked, which typically leads to higher costs.

Understanding these factors will arm you with the knowledge needed to make informed decisions when comparing bookkeeping services price lists. The goal is to find a service that offers the best value for your specific needs, balancing cost with the quality and range of services offered.

As we explore further, keep these factors in mind to help guide your decision-making process.

Average Bookkeeping Service Rates

When you’re comparing bookkeeping services price lists, it’s crucial to have a clear picture of the average costs involved. This will help you set realistic expectations and budget accordingly. Let’s break down the typical rates you might encounter.

Hourly Rates

The most straightforward pricing model you’ll come across is the hourly rate. On average, bookkeepers in the U.S. charge about $22 per hour. However, this rate can vary significantly based on the bookkeeper’s experience, location, and the complexity of your financial needs. For straightforward tasks, you might pay less, but for more complex services, especially those requiring specialized knowledge, the rate can be much higher.

CPA Charges

Certified Public Accountants (CPAs) are on the higher end of the spectrum when it comes to pricing. They typically charge between $200 and $250 per hour. Their expertise in tax planning, financial analysis, and strategic advice justifies the higher rates. If your business requires in-depth financial management, investing in a CPA’s services might be worthwhile.

Major City Rates

Location plays a significant role in determining bookkeeping rates. In major cities, where the cost of living and operating a business is higher, top bookkeepers may charge $500 per hour or more. This reflects the competitive market, higher demand for services, and the increased expertise and speed that top professionals in these areas often provide.

Outsourced Bookkeeping Costs

Outsourcing bookkeeping services can be a cost-effective solution for many businesses. It eliminates the need for an in-house bookkeeper, saving on salary, benefits, and training costs. Outsourced bookkeeping services can range widely in price, from basic packages around $150 per month to comprehensive services that can exceed $1,000 monthly. The exact cost will depend on the volume of transactions, number of accounts, and specific services required.

Key Takeaway: The average bookkeeping service rates vary widely, influenced by factors such as the service provider’s qualifications, your business’s location, and the complexity of the services needed. Hourly rates offer flexibility, while CPA charges reflect a higher level of expertise. Major city rates are generally higher due to increased demand and operating costs. Outsourced bookkeeping presents a scalable solution that can be tailored to your business’s needs, offering a balance between cost and convenience.

With this understanding of average rates, you’re better equipped to navigate the bookkeeping services price list and find the option that best suits your financial and operational requirements. Keep these averages in mind to ensure you choose the right bookkeeping service for your business’s unique needs.

Comparing Bookkeeping Pricing Structures

Navigating the bookkeeping services price list can feel like a maze. But don’t worry, we’re here to help you understand the different pricing structures. Each has its own set of advantages and challenges.

Hourly Rate Pricing

Pros:

- Flexibility: You pay for exactly the amount of work done. If your bookkeeping needs are lower some months, you pay less.

- Simplicity: It’s straightforward. You know the hourly rate, so it’s easy to understand what you’re paying for.

Cons:

- Unpredictability: Costs can vary month to month, making it hard to budget.

- Potential for higher costs: If your bookkeeping needs are complex, you might end up paying more than with other models.

Industry Averages: Typically ranges from $30 to $100 per hour.

Fixed-Rate Pricing

Pros:

- Predictability: You know your cost upfront, making budgeting easier.

- Incentive for efficiency: Bookkeepers are motivated to work efficiently since the fee doesn’t change based on hours worked.

Cons:

- Risk of overpaying: If your needs are minimal in some months, you might pay more than the work required.

- Scope creep: If your needs expand, renegotiating the fixed rate can be necessary.

Menu Pricing: Offers a clear list of services with set prices, making it easy to understand what you’re getting.

Scalability: As your business grows, you can easily move to a higher tier of service without renegotiating the entire contract.

Value-Based Pricing

Pros:

- Aligned interests: The focus is on the value provided, not the hours worked, encouraging bookkeepers to contribute to your business’s success.

- Customization: Pricing is tailored to the specific benefits you receive, making it highly personalized.

Cons:

- Subjectivity: Determining the value can be more complex and require negotiation.

- Higher upfront costs: Since the service is highly tailored, initial costs might be higher than other models.

Client Value & Efficiency: This model rewards both parties for efficiency and effectiveness, potentially leading to better long-term outcomes for your business.

Percentage of Client’s Income

Pros:

- Growth alignment: Costs rise only as your business grows, which can be beneficial for startups.

- Simplicity: Easy to understand and predict as it’s directly tied to your revenue.

Cons:

- Potential for higher costs: As your business grows, you might end up paying more than with a fixed or hourly rate.

- Less predictability: Fluctuating revenues mean fluctuating costs.

Revenue-Based: This model is suitable for businesses with variable incomes, providing flexibility and scalability.

Per Transaction Pricing

Pros:

- Direct correlation: You pay for the exact number of transactions, making costs directly tied to your business activity.

- Scalability: Costs naturally scale with the volume of your transactions.

Cons:

- Variable costs: Like with hourly rates, your costs can vary, making budgeting challenging.

- Potential for high costs: If your transaction volume is high, this can become an expensive model.

Transaction Volume & Suitability: Best for businesses with consistent transaction volumes, where costs can be predicted with some accuracy.

Each pricing structure has its place depending on your business size, transaction volume, and financial stability. Whether you prefer the predictability of fixed-rate pricing or the scalability of per transaction pricing, understanding these models is key to making an informed decision. As we move into the FAQs, keep these pros and cons in mind to further refine your understanding and choose the best bookkeeping service for your needs.

Frequently Asked Questions about Bookkeeping Pricing

When it comes to bookkeeping pricing, there are several common questions that both bookkeepers and businesses tend to have. Let’s dive into some of these questions to give you a clearer picture.

How Much Should You Pay Someone to Do Your Bookkeeping?

For businesses looking to outsource their bookkeeping, costs can vary significantly. Outsourcing costs depend on the complexity of your financial transactions, the volume of work, and the level of expertise required. On average, small to medium-sized businesses might expect to pay anywhere from $500 to $2,500 per month for comprehensive bookkeeping services.

Monthly fees are common in fixed-rate pricing models, where businesses pay a set amount each month for a bundle of services. This model can be more predictable and easier to budget for compared to hourly rates.

When considering how much to pay for bookkeeping services, reflect on the value that accurate and up-to-date financial records bring to your business. Professional bookkeeping can save you time, provide valuable financial insights, and help you avoid costly mistakes.

Remember, the cheapest option isn’t always the best when it comes to bookkeeping services. Quality, reliability, and a good fit with your business needs are equally important as the price.

In conclusion, whether you’re a bookkeeper determining how to price your services or a business looking into outsourcing your bookkeeping, it’s essential to weigh all factors carefully. The right bookkeeping service and pricing model can provide significant value to your business, helping you manage your finances more effectively and make informed decisions for growth.

Conclusion

Choosing the right bookkeeping pricing model isn’t just about the numbers; it’s about finding a balance that works for both the service provider and the client. It means aligning the bookkeeping services price list with the value delivered, ensuring businesses can effectively manage their finances without breaking the bank, and bookkeepers can sustainably offer their expertise.

At Rockerbox Tax Solutions, we understand the importance of this balance. We believe in transparent, value-based pricing that reflects the comprehensive support and tailored services we provide to each client. Our goal is to become more than just a service provider; we aim to be a financial ally to your business.

Choosing the Right Pricing Model

When it comes to selecting a pricing model, consider the following:

- Your Business Needs: Are you looking for comprehensive bookkeeping services, or do you need support with specific tasks? Your requirements will influence the best pricing model for you.

- The Value Offered: Beyond the numbers, consider the value a bookkeeping service adds to your business. This includes their expertise, the technology they use, and the efficiency they bring to your financial operations.

- Flexibility and Scalability: As your business grows, your bookkeeping needs will evolve. Choose a service that offers flexibility and can scale with you.

Rockerbox Tax Solutions

Why choose us for your bookkeeping needs? Here’s what sets us apart:

- Tailored Services: We don’t believe in one-size-fits-all solutions. Our services are customized to meet the unique needs of your business.

- Expert Team: Our team of professionals is equipped with the knowledge and experience to handle your bookkeeping, tax, and financial management needs.

- Technology-Driven: We leverage the latest technology to ensure efficient and accurate bookkeeping, giving you real-time access to your financial data.

- Value-Based Pricing: Our pricing reflects the value we provide, ensuring you get top-notch services that support the growth and success of your business.

In conclusion, selecting the right bookkeeping service and pricing model is crucial for your business’s financial health. At Rockerbox Tax Solutions, we’re committed to providing services that not only meet your bookkeeping needs but also contribute to your overall success. Let us handle the details, so you can focus on what you do best: growing your business.