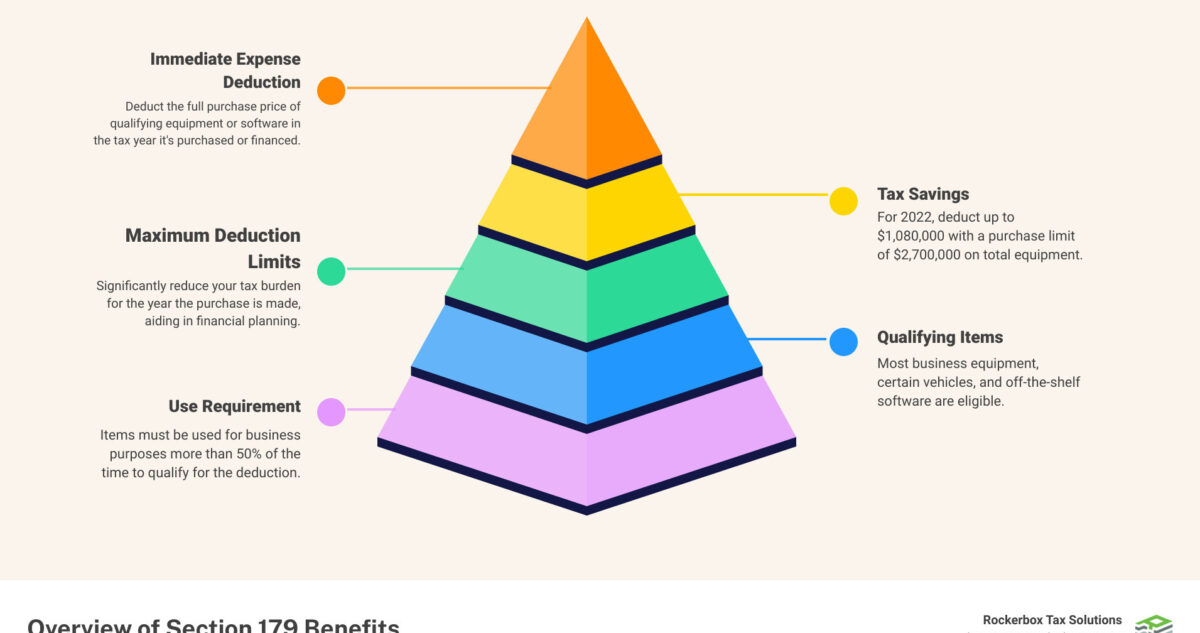

Quick Guide: How Does Section 179 Work?

- Immediate Expense Deduction: Allows businesses to deduct the full purchase price of qualifying equipment or software within the tax year it is purchased or financed.

- Tax Savings: Offers an opportunity to significantly reduce the tax burden for the year the purchase is made.

- Maximum Deduction Limits: For 2022, the limit is $1,080,000 with a total equipment purchase limit of $2,700,000.

- Qualifying Items: Includes most business equipment, certain vehicles, and off-the-shelf software.

- Use Requirement: The item must be used for business purposes more than 50% of the time to qualify.

Navigating the complex world of taxes can be daunting for small and medium-sized business owners. Section 179 of the U.S. Internal Revenue Code stands out as a beacon of hope, offering immediate financial relief through tax deductions on the purchase of business equipment. It allows you to deduct the full price of qualifying items from your taxable income for the year they were purchased or financed, offering significant tax savings. This makes Section 179 a powerful tool for businesses looking to invest in their growth while managing their tax liabilities effectively.

The importance of Section 179 can’t be overstated. It not only aids in reducing the current year’s tax bill but also encourages businesses to invest in new equipment, technology, and assets that can drive growth and efficiency. Understanding and utilizing Section 179 rightly can mean the difference between maintaining the status quo and propelling your business forward with strategic investments, all while saving on taxes.

Understanding Section 179

Let’s dive into how does Section 179 work. It’s like finding a hidden gem in the tax code that can save your business a lot of money. Here’s the simple breakdown:

- Tax Code: Think of the U.S. tax code as a giant rule book for taxes. Section 179 is one chapter of that book. It’s specially written for business owners who buy equipment for their business.

- Immediate Expense Deduction: Normally, when your business buys something like a computer or a machine, you can’t just write off the entire cost in the year you buy it. You have to spread the cost out over several years. But with Section 179, you can take the whole cost as a deduction in the year you buy and start using the equipment. It’s like getting a discount on your taxes for investing in your business.

- Depreciable Business Equipment: This part is about what you can actually buy and deduct under Section 179. It’s not just any old purchase. The equipment has to be something you use in your business, and it has to be something that loses value over time (that’s what “depreciable” means). This includes things like computers, machinery, and even some types of software.

Why It Matters

Using Section 179 can make a big difference at tax time. Instead of waiting years to get back the money you spent on equipment, you get it back right away. This can help your cash flow and make it easier to invest in more equipment or other areas of your business.

Example

Imagine you buy a new machine for your business for $50,000. Normally, you might have to spread that cost out over 5 years, which means you’d get a $10,000 deduction each year. But with Section 179, you can take the entire $50,000 as a deduction in the year you buy the machine. That can lower your tax bill significantly in that year.

There are limits and rules about how much you can deduct and what kinds of equipment qualify. For 2023, the maximum you can deduct is $1,160,000, and there’s a spending cap of $2,890,000 on equipment purchases. If you buy more than that, the amount you can deduct starts to decrease.

Takeaway

Section 179 is a powerful tool for businesses. It encourages you to invest in equipment that can improve your business by offering a tax incentive to do so. But, like any tax rule, it’s important to understand the details and plan carefully. Make sure the equipment you buy really qualifies, and consider talking to a tax professional to make the most of this deduction.

In the next section, we’ll explore the differences between Section 179 and another tax-saving option: bonus depreciation. Stay tuned to see how you can maximize your benefits and strategically plan your purchases.

By understanding how does Section 179 work, you’re unlocking potential savings and making smarter choices for your business’s growth and efficiency.

Eligibility Criteria for Section 179

When we dive into tax deductions, Section 179 stands out as a powerful tool for businesses, but not everything qualifies. Let’s break down the eligibility criteria to see if you can make this tax code work for you.

Business Use Requirement

First things first, the equipment or software you’re looking to write off must be used for business purposes more than 50% of the time. This is a key requirement. If you buy a computer and use it half for your business and half for personal Netflix binges, only the business-use portion is eligible.

Types of Property

Not all items under the sun qualify for Section 179. The property must be tangible, depreciable, and used in the active conduct of a business. This means it needs to be something you can touch (so no intangible assets like trademarks), and it should lose value over time.

Qualifying Equipment

Here’s where it gets interesting. A wide range of equipment falls under Section 179, including:

- Office Furniture: Desks, chairs, and lamps.

- Machinery: For manufacturing, printing, or any other business operation.

- Computers and Off-the-Shelf Software: As long as the software is readily available for purchase by the general public, carries a non-exclusive license, and has not been substantially modified.

- Vehicles: Restrictions apply, but many business-use vehicles are eligible.

- Property Attached to Your Building: This isn’t about the building itself but includes improvements like security systems, HVAC, and roofing.

To qualify, these items must be purchased or financed and put into use between January 1 and December 31 of the tax year you’re claiming.

A Real-World Example:

Imagine a small business owner, Alex, who runs a digital marketing agency. In 2024, Alex decides to upgrade the office with new computers and software to boost productivity. The total comes to $30,000, well within the Section 179 limits for that year. Since these computers and software are used 100% for business, Alex can deduct the full purchase price from the company’s gross income, potentially saving thousands in taxes.

Key Takeaways:

- Use Percentage Matters: Only the business-use portion is eligible.

- Tangible and Depreciable: The property must be something you can touch and expect to deteriorate over time.

- Wide Range of Equipment: From office furniture to machinery and computers, many items qualify.

- Timing is Crucial: Purchases must be made and used within the same tax year.

Understanding the eligibility criteria for Section 179 can significantly impact your tax planning. By strategically purchasing or financing business equipment, you can leverage this deduction to reinvest in your business’s growth. As we move into the next section, keep in mind how pairing Section 179 with bonus depreciation can further enhance your savings.

Stay informed and consider consulting with professionals like Rockerbox Tax Solutions to navigate these opportunities effectively.

Calculating Your Section 179 Deduction

Understanding how does section 179 work is crucial when you’re looking to maximize your tax benefits. Let’s break down the key components that determine your Section 179 deduction: Maximum Deduction Limits, Purchase Price, Business-Use Percentage, and walk through some Example Calculations.

Maximum Deduction Limits

For the 2023 tax year, the maximum you can deduct under Section 179 is $1,160,000. This cap increases to $1,220,000 in 2024. These limits can change, as they are regularly updated to reflect inflation and new tax laws.

Purchase Price

The total price of the purchased or leased equipment directly influences your deduction amount. However, there’s a catch: if your total equipment purchases exceed $3,050,000 in a year, the deduction begins to phase out on a dollar-for-dollar basis. This ensures the deduction’s focus remains on small to medium-sized businesses.

Business-Use Percentage

Not all use of your equipment may qualify for Section 179. The IRS requires that the equipment be used for business purposes more than 50% of the time to qualify for the deduction. The deduction amount will then be multiplied by the percentage of business use. For instance, if a computer worth $2,000 is used 80% of the time for business, you can only deduct $1,600 under Section 179.

Example Calculations

Let’s put this into perspective with a simple example:

Imagine you’ve purchased equipment worth $500,000 in 2023, and your total business purchases for the year don’t exceed the $3,050,000 limit. Assuming this equipment is used 100% for business purposes, you’re eligible to deduct the entire $500,000 from your taxable income under Section 179.

Example 2: Suppose you bought an SUV for your business, which qualifies under Section 179, and you use it 70% for business. If the SUV cost $50,000, your deduction would be $35,000 (70% of $50,000), assuming your total purchases don’t exceed the phase-out threshold.

Navigating Section 179 with Rockerbox Tax Solutions

Calculating your Section 179 deduction correctly can significantly impact your business’s financial health. It’s not just about understanding the basics; it’s about strategically planning your purchases and usage to maximize your deduction. Rockerbox Tax Solutions can guide you through this process, ensuring you’re leveraging every opportunity Section 179 offers.

As we transition into comparing Section 179 with bonus depreciation, remember: each business’s situation is unique. The best approach combines a solid understanding of these tax codes with tailored advice from tax professionals.

Stay tuned as we explore how to further enhance your tax savings by strategically using Section 179 in conjunction with bonus depreciation.

Section 179 vs. Bonus Depreciation

When it comes to maximizing tax savings, understanding the difference between Section 179 and bonus depreciation is crucial. Let’s break it down in simple terms to help you make informed decisions.

Flexibility

Section 179 offers flexibility. You can choose which assets to apply it to and how much of the deduction to use, up to the limit. This makes it a powerful tool for managing your taxable income.

Bonus Depreciation, on the other hand, is applied automatically to all qualifying assets, without the option to pick and choose. However, in 2024, it allows for a 60% deduction, which includes both new and used equipment.

Caps

Both options have caps, but they differ significantly:

- Section 179 has a deduction limit of $1,220,000 for 2024, with a total purchase limit of $3,050,000. Beyond this purchase limit, the deduction starts to phase out.

- Bonus Depreciation does not have a specific cap, making it especially beneficial for businesses making very large investments in qualifying assets.

Bonus Depreciation

A key feature of bonus depreciation is its ability to cover 100% of the cost of new assets. However, starting in 2023, it began to phase out, reducing to 80% and set to decrease further until it’s no longer available after 2026. Unlike Section 179, bonus depreciation can be applied without a spending cap, making it ideal for businesses with significant investments.

Strategic Use

For optimal tax savings, businesses typically use Section 179 first to deduct the full purchase price of qualifying equipment up to the cap. Bonus Depreciation is then applied to the remaining balance, allowing businesses to maximize their immediate deductions.

Net Loss Carryforward

An advantage of bonus depreciation is its ability to create or increase a net operating loss, which can be carried forward to offset future taxable income. This is particularly useful for businesses that are in a net loss position, allowing them to still benefit from their investments.

In Summary, choosing between Section 179 and bonus depreciation depends on your business’s specific situation, including how much you plan to invest in equipment and your taxable income. While Section 179 provides a direct deduction with a cap, bonus depreciation offers a percentage-based deduction without a spending limit, beneficial for larger investments.

For businesses aiming to maximize their tax benefits, leveraging both Section 179 and bonus depreciation strategically can lead to significant savings. However, navigating these options can be complex, and it’s often wise to consult with tax professionals, like those at Rockerbox Tax Solutions, to tailor a strategy that fits your business needs perfectly.

Let’s dive into how you can maximize the benefits of Section 179 for your business, ensuring you make the most of this tax-saving opportunity.

Maximizing Benefits with Section 179

Navigating taxes can feel like trying to find your way through a maze. But, with the right strategy, you can turn a confusing path into a straight line to tax savings. Let’s talk about how does Section 179 work and how you can maximize its benefits with careful planning, smart timing, and exploring financing options. Rockerbox Tax Solutions can guide you through this process, ensuring you make the most of your deductions.

Planning Purchases

When it comes to Section 179, timing is everything. Planning your purchases can make a big difference in your tax savings. Here’s a simple approach:

- List What You Need: Start by listing the equipment your business needs. Both new and used items can qualify.

- Prioritize: Not all purchases offer the same tax benefits. Prioritize those that give you the most bang for your buck.

Timing

The timing of your purchase can significantly impact your tax savings. Here’s why:

- Tax Year Consideration: To deduct the full purchase price, you need to buy and start using the equipment in the same tax year.

- End-of-Year Purchases: Many businesses find that buying at the end of the year is beneficial. It allows them to assess their profits and make purchases that can lower their taxable income.

Financing Options

Did you know that financing your purchase can still qualify you for Section 179 deductions? Here’s the scoop:

- Financing vs. Cash: Whether you pay cash or finance the purchase, you can still deduct the full purchase price under Section 179.

- Smart Financing: Financing can keep your cash flow intact while still allowing you to take advantage of the deduction.

Rockerbox Tax Solutions

Why go at it alone when you can have experts by your side? Rockerbox Tax Solutions specializes in helping businesses navigate the complexities of tax deductions, including Section 179. Here’s how they can help:

- Tailored Advice: Every business is unique. Rockerbox offers personalized advice based on your specific business needs.

- Maximizing Deductions: They can help you plan and time your purchases to maximize your deductions.

- Financing Guidance: If you’re considering financing, they can guide you through the options to ensure it aligns with your tax strategy.

In Summary

Maximizing the benefits of Section 179 requires a bit of strategy. By planning your purchases, timing them wisely, and exploring financing options, you can significantly reduce your taxable income. And with Rockerbox Tax Solutions by your side, you can navigate these decisions with confidence, ensuring you make the most of this valuable tax-saving opportunity.

As we wrap up this section, staying informed and seeking expert advice is key to leveraging tax codes like Section 179 to your advantage. Next, we’ll answer some frequently asked questions about Section 179 to clear up any remaining uncertainties.

Frequently Asked Questions about Section 179

Navigating through tax codes can be quite the maze. Let’s simplify some of the most common queries about Section 179.

How much can you write off with Section 179?

For the tax year 2023, businesses can write off up to $1,160,000 of qualifying equipment. This limit increases to $1,220,000 in 2024. However, it’s important to note that there’s a total purchase limit. For 2023, this limit is $2.89 million, beyond which the deduction starts to phase out dollar for dollar.

What types of equipment qualify for Section 179?

Think of Section 179 as a way to get a tax break on tangible goods that help your business thrive. This includes:

- Office Furniture: Desks, chairs, and filing cabinets.

- Computers and Off-the-Shelf Software: As long as it’s not custom-made specifically for your business.

- Business Vehicles: Generally, vehicles over 6,000 lbs GVW qualify.

- Machinery and Equipment: Anything from factory machines to coffee makers for the office kitchen.

The rule of thumb here is if it’s used for business more than 50% of the time, it likely qualifies.

Can Section 179 be used every year?

Absolutely! Section 179 isn’t a one-and-done deal. It’s a tax incentive designed to encourage businesses to invest in themselves annually. Thanks to the Protecting Americans from Tax Hikes Act of 2015 (PATH Act), Section 179 is a permanent part of the tax code. So, yes, you can and should consider taking advantage of it every year, as long as you’re making qualifying purchases.

Remember, the aim of Section 179 is to make tax time a bit more bearable and to fuel business growth through investment. Whether you’re planning to upgrade your office computers or considering a new company vehicle, Section 179 can offer significant savings, reducing the overall cost of investments and potentially improving your bottom line. For personalized advice and to ensure you’re making the most out of this opportunity, consider reaching out to Rockerbox Tax Solutions. They’re well-versed in the nuances of Section 179 and can help tailor a strategy that fits your business needs.

Conclusion

As we wrap up our guide on how does Section 179 work, it’s clear that understanding and utilizing this part of the tax code can significantly impact your business’s financial health. Section 179 isn’t just about tax savings—it’s a strategic tool that, when used wisely, can aid in the growth and scalability of your operations.

Tax Mitigation Strategies play a crucial role in maximizing your benefits under Section 179. By planning your equipment purchases and understanding the nuances of qualifying expenses, you can leverage Section 179 to not only reduce your taxable income but also to reinvest in your business’s future. Every dollar saved in taxes through deductions like Section 179 is a dollar that can be used for further investment, research and development, or expanding your business footprint.

Future Planning is essential when considering Section 179. The tax code and its benefits, including deduction limits and qualifying equipment, can change. Staying informed and adaptable ensures that your business can continue to benefit from Section 179 and other tax mitigation strategies year after year. This is where a solid relationship with a tax professional becomes invaluable.

At Rockerbox Tax Solutions, we specialize in unlocking the hidden savings in your tax strategy. Our expertise in Section 179 and other tax mitigation solutions is designed to not only minimize your current tax liabilities but also to position your business for future success. We understand that every business is unique, and our tailored approach aims to align with your specific financial circumstances and goals.

In conclusion, Section 179 is more than just a tax deduction—it’s an opportunity for businesses to invest in themselves while managing their tax liabilities. Whether you’re planning to purchase new equipment or you’re looking for ways to optimize your tax strategy, you don’t have to navigate these decisions alone.

Let Rockerbox Tax Solutions be your partner in building a more prosperous future for your business. Together, we can develop a comprehensive tax mitigation strategy that maximizes your wealth and positions your business for sustained growth.

Thank you for joining us on this journey through the intricacies of Section 179. We hope this guide has illuminated the path to greater tax savings and strategic business investments.