Investing in solar energy is not just good for the planet—it’s also smart for your wallet, thanks to the Federal Solar Tax Credit. If you’ve installed solar panels or other renewable energy systems, you might be eligible to save up to 30% on installation costs through this credit. But how does the IRS make sure your claim is legitimate?

Quick Answer: The IRS requires homeowners to file IRS Form 5695 with their tax return, keep detailed records and documentation of their solar installation (including receipts and manufacturer certifications), and ensures that the technology installed meets approved industry standards.

Solar energy represents a significant step towards sustainable and eco-friendly living. The Federal Solar Tax Credit is designed to make this leap more accessible to more people by reducing the initial financial burden. Whether you’re a homeowner adding panels to your roof or a small business investing in a more extensive system, this incentive could mean significant savings.

Understanding the process behind the IRS’s verification of solar credits can demystify the claims process and ensure you’re prepared to take full advantage of this benefit. It’s about making renewable energy more affordable for everyone, encouraging wider adoption, and supporting the nation’s goals for a cleaner, greener future.

With a tone aimed at simplifying complexity, the introduction seeks to align with the needs of business owners and individuals looking to navigate the nuanced landscape of solar tax credits confidently. By honing in on essential steps and providing a structure for the article, readers can anticipate a clear roadmap to leveraging federal incentives for their renewable energy investments.

Eligibility for the Solar Tax Credit

When it comes to making your home more energy-efficient and tapping into the power of the sun, the Federal Solar Tax Credit is a fantastic way to save money. But, not everyone or every installation qualifies. Let’s break down the basics of eligibility, so you know exactly where you stand.

Homeownership

First things first, you need to own your home. This might seem obvious, but it’s an essential starting point. If you’re renting, you won’t be able to claim the credit, even if you paid for the solar installation yourself.

Primary Residence

Your solar installation must be on your primary residence to qualify for the full credit. That said, if you install solar panels on a vacation home or a secondary residence, you might still be eligible for a partial credit. The key here is that the property must not be rented out for the majority of the year.

Installation Costs

Here’s where things get interesting. The solar tax credit covers a broad range of installation costs. This isn’t just about the solar panels themselves. It includes labor costs, assembly and original installation costs, and even the cost of wiring to connect the solar system to your home. Keep every receipt related to your solar installation; you’ll need them when it’s time to claim your credit.

IRS Form 5695

To actually claim the credit, you’ll need to fill out IRS Form 5695. This form is your ticket to reducing your tax liability thanks to your solar investment. It’s not overly complicated, but it does require accurate information about your solar installation, including costs and specifics about the system itself.

Remember: The solar tax credit is a nonrefundable credit. This means it can reduce your tax bill to zero, but you won’t get a refund based on this credit alone. However, if your credit exceeds your tax liability, you can carry the remaining credit over to the next tax year.

In conclusion, ensuring you meet the eligibility criteria for the Solar Tax Credit can lead to significant savings on your tax bill. Keep detailed records, understand the specifics of your installation, and when in doubt, consult a tax professional. With the right preparation, you can make the most of this incentive and invest in a greener future for your home.

We’ll dive into the specifics of how the IRS verifies solar credits. This includes the importance of documentation, manufacturer certifications, and adhering to approved industry standards. Stay tuned to ensure your claim is solid and you’re set to enjoy the benefits of your renewable energy investment.

How the IRS Verifies Solar Credits

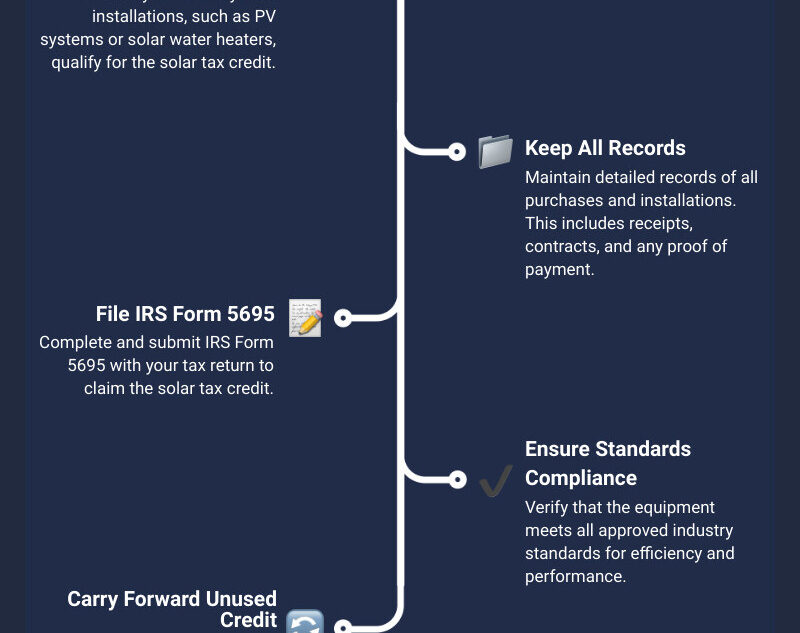

When you’re ready to claim your solar tax credit, understanding how the IRS verifies solar credit is crucial to ensure a smooth process. Let’s break it down into simple steps:

Documentation

First off, the IRS loves paperwork. When claiming your solar tax credit, you’ll need to have all your ducks in a row. This means keeping detailed records of everything related to your solar installation. We’re talking about invoices, contracts, bank statements, and any other document that shows what you spent on your solar system. It’s like keeping a diary, but for your solar panels.

Manufacturer Certifications

Next up, we have manufacturer certifications. These are basically gold stars from your solar equipment’s manufacturers. They prove that your solar panels, inverters, and other components meet specific performance and quality standards. The IRS uses these certifications to verify that your system is legit and eligible for the tax credit. It’s like showing a hall pass to the taxman.

Approved Industry Standards

The IRS doesn’t just take anyone’s word for it. Your solar system needs to meet approved industry standards. This means that your solar setup should be up to code and follow guidelines set by recognized authorities in the solar industry. It’s a bit like making sure your car passes inspection before hitting the road.

Cross-Referencing

Finally, the IRS may cross-reference the information you provide with other sources. This could include checking your claims against data from solar installers, utility companies, or local government permits. It’s their way of double-checking your homework to make sure everything adds up.

In summary, when wondering how the IRS verifies solar credit, remember it’s all about the details. Keep thorough records, make sure your equipment is certified, adhere to industry standards, and be prepared for the IRS to cross-check your information. By following these steps, you can navigate the verification process like a pro and enjoy the benefits of your solar investment.

Next up, we’ll guide you through the step-by-step process of claiming your solar tax credit on IRS Form 5695. Whether you’re calculating your credit, understanding your tax liability, or carrying forward a nonrefundable credit, we’ve got you covered. Stay tuned to make the most out of your renewable energy incentives.

Claiming the Solar Tax Credit: A Step-by-Step Process

Claiming the solar tax credit might sound daunting, but it’s actually quite straightforward once you know the steps. Let’s walk through the process, focusing on IRS Form 5695, how to calculate your credit, understanding tax liability, and what it means to carry forward a nonrefundable credit.

Step 1: Fill Out IRS Form 5695

First things first, grab a copy of IRS Form 5695. This form is your gateway to claiming the solar tax credit. It’s designed to calculate and state the amount of credit you’re eligible for based on your qualified solar energy expenses. You can find the form on the IRS website or by clicking here.

Step 2: Calculate Your Credit

On Form 5695, you’ll input the total cost of your solar energy system, including both equipment and installation costs. The form will guide you through calculating 30% of these costs, which represents the amount of credit you’re eligible for. It’s important to include all eligible expenses to maximize your credit.

Understanding Your Tax Liability

Your tax liability is essentially how much tax you owe to the IRS before applying any credits or deductions. The solar tax credit can only reduce your tax liability; it can’t turn into a refund. If the credit is more than your tax liability, you won’t get the difference back in your tax refund. However, there’s a silver lining which we’ll cover in the next step.

Step 3: Carry Forward Nonrefundable Credit

What if your solar tax credit exceeds your tax liability? Don’t worry; you won’t lose the excess credit. The IRS allows you to carry forward the unused portion of your credit to the next tax year. This means if you can’t use all of your solar tax credit this year, you can apply it to reduce your tax liability next year.

Nonrefundable Credit: What It Means

The solar tax credit is nonrefundable. This means it can reduce your tax bill to zero, but you won’t receive any of the credit’s value as a refund. Instead, as mentioned, you can carry forward any unused credit to future tax years.

In Summary:

- Fill out IRS Form 5695 with your solar installation costs.

- Calculate your credit as 30% of the total eligible costs.

- Understand that the credit can only reduce your tax liability.

- If your credit exceeds your liability, you can carry forward the unused amount to the next tax year.

- The credit is nonrefundable; it reduces your tax owed but doesn’t directly translate into a cash refund.

By following these steps, you can confidently claim your solar tax credit and enjoy the benefits of renewable energy while saving on your taxes. If you’re ever unsure about your eligibility or how to fill out the form, consider consulting with a tax professional to ensure you’re making the most of your investment.

Common Questions on Solar Tax Credit Verification

When it comes to understanding how the IRS verifies solar credit, many homeowners have questions. Let’s dive into some of the most common ones.

What Qualifies for the Solar Tax Credit?

First off, not everything under the sun (pun intended) qualifies for the solar tax credit. Here’s a quick list of what does:

- Solar PV Systems: These are the panels you see on rooftops, converting sunlight into electricity.

- Solar Water Heaters: As long as they’re used in the home and not for heating a pool or hot tub.

- Wind Turbines: Small, residential-sized turbines qualify.

- Geothermal Heat Pumps: These use the stable temperature underground to heat and cool your home.

- Battery Storage: New to the game, but yes, certain battery storage systems qualify too.

How to Maximize Your Solar Tax Credit?

To get the most out of your solar tax credit:

- Include Installation Costs: When calculating your credit, don’t forget to include the cost of labor for installing your system.

- Count Energy Storage: If you’re installing a new solar system with energy storage, those costs can also count toward the credit.

- Don’t Forget Professional Fees: Engineering and permitting fees are part of the installation cost and qualify for the credit.

What Happens If Your Solar Tax Credit Claim Is Denied?

If the IRS denies your claim for the solar tax credit, here’s what tends to happen:

- IRS Notification: You’ll receive a notice from the IRS explaining why your claim was denied.

- Adjustments: You may need to adjust your tax return accordingly, which could affect your future tax liabilities.

The key to a smooth verification process with the IRS is thorough documentation. Keep all receipts and manufacturer certifications for your solar technology installation. If you’re ever in doubt, consulting with a tax professional, like those at Rockerbox Tax Solutions, can help ensure you’re on the right track.

By understanding what qualifies, how to maximize your credit, and what to do if your claim is denied, you’re well on your way to making the most of the solar tax credit. Don’t let the complexity of tax codes deter you from taking advantage of this incredible opportunity to save on your taxes and support renewable energy.

Conclusion

As we wrap up our guide on understanding how the IRS verifies solar credits, it’s clear that navigating the solar tax credit can be complex, but it’s also incredibly rewarding. By ensuring you meet the eligibility criteria, properly document your expenses, and accurately claim your credit, you can significantly reduce your tax liability while contributing to a more sustainable future.

At Rockerbox Tax Solutions, we specialize in helping individuals and businesses navigate the complexities of tax mitigation strategies, including taking full advantage of renewable energy incentives. Our team of experts is dedicated to providing you with the guidance and support you need to maximize your tax savings and make informed decisions about your investments in renewable energy. Explore our tax mitigation solutions to discover how we can help you minimize your taxes and maximize your wealth.

Looking ahead, the future of renewable energy incentives remains bright. As the world continues to prioritize sustainability and green energy, we can anticipate ongoing support from both federal and state governments in the form of tax credits, rebates, and other incentives. These policies not only make it more financially viable for individuals and businesses to invest in renewable energy but also play a crucial role in our collective efforts to combat climate change.

In conclusion, the solar tax credit represents a valuable opportunity for taxpayers to reduce their tax liability while supporting the transition to renewable energy. By leveraging the expertise of Rockerbox Tax Solutions and staying informed about the latest in tax mitigation strategies and renewable energy incentives, you can ensure that you’re making the most of this opportunity. Together, we can work towards a more sustainable and financially savvy future.